Crypto ETF Explained: A Guide to the Game-Changing Investment

The term "Crypto ETF" has been one of the most talked-about topics in the financial world, and for good reason. The launch of the first spot Bitcoin ETFs in the United States in early 2024 was a watershed moment for the digital asset industry, fundamentally changing the game for both individual and institutional investors.

But what exactly is a crypto ETF, how does it work, and what does it mean for the future of crypto? This guide will explain everything you need to know about this revolutionary financial product.

What is an ETF?

First, let's understand the basics. An ETF (Exchange-Traded Fund) is a type of investment fund that is traded on a stock exchange, just like a regular stock. An ETF is designed to track the performance of a specific asset or a basket of assets. For example, an S&P 500 ETF tracks the performance of the 500 largest companies in the U.S. stock market.

The key benefit of an ETF is that it provides investors with an easy and regulated way to gain exposure to an asset without having to own the underlying asset itself.

What is a Crypto ETF?

A crypto ETF is simply an ETF that tracks the price of one or more cryptocurrencies. The most significant and widely discussed type is the spot crypto ETF.

- How a Spot Crypto ETF Works:

- An asset management firm (like BlackRock or Fidelity) creates a fund.

- The fund buys and holds the actual cryptocurrency (e.g., Bitcoin) in a secure, regulated custody solution.

- The firm then issues shares of this fund, and these shares are listed on a traditional stock exchange, like the NYSE or Nasdaq.

- You, the investor, can buy and sell these shares through your regular brokerage account (e.g., Fidelity, Charles Schwab), just as you would buy shares of Apple or Tesla.

The value of your ETF shares is designed to directly track the market price of the underlying cryptocurrency.

Why is the Spot Bitcoin ETF Such a Big Deal?

The approval of the spot Bitcoin ETFs in the U.S. was a game-changer for several reasons:

- Accessibility: It allows anyone with a brokerage account to invest in Bitcoin. This opens the door to millions of investors who were hesitant or unable to sign up for a crypto exchange and deal with the complexities of self-custody.

- Regulatory Clarity and Trust: The fact that these products are approved and regulated by the U.S. Securities and Exchange Commission (SEC) provides a massive stamp of legitimacy for the asset class.

- Institutional Capital: It provides a safe and compliant way for large institutional investors, such as pension funds and endowments, to allocate a portion of their portfolios to Bitcoin. This unlocks a potentially massive new wave of capital into the market.

- Simplicity: You don't have to worry about managing private keys or choosing a crypto wallet. The ETF issuer handles the complex and high-stakes job of securely storing the Bitcoin.

Spot ETF vs. Futures ETF: What's the Difference?

Before the spot Bitcoin ETF was approved, the only crypto ETFs available in the U.S. were based on futures contracts.

- Futures ETF: This type of ETF does not hold the actual crypto. Instead, it holds futures contracts, which are agreements to buy or sell the crypto at a future date. While they provide exposure to the price, they can sometimes be less accurate in tracking the spot price and can incur additional costs from "rolling" the futures contracts.

- Spot ETF: This type of ETF holds the underlying asset directly. It is a more direct, simple, and accurate way to get exposure to the real-time price of the cryptocurrency. For this reason, the launch of the spot ETFs was such a significant event.

What's Next? The Potential for an Ethereum ETF and Beyond

With the successful launch of the spot Bitcoin ETFs, the market's attention has turned to the next logical step: a spot Ethereum ETF. The potential approval of an ETF for the second-largest cryptocurrency could bring a similar wave of new capital and legitimacy to the Ethereum ecosystem and the broader world of Web3 and DeFi.

Looking further ahead, it's possible that we could one day see ETFs for other major cryptocurrencies or even for a basket of different digital assets, which would function like a "Crypto S&P 500."

How to Invest in a Crypto ETF

Investing in a spot Bitcoin ETF is incredibly simple:

- Log in to your standard brokerage account (e.g., Fidelity, Vanguard, E*TRADE).

- Search for the ticker symbol of the Bitcoin ETF you want to buy (e.g., IBIT for BlackRock's ETF, FBTC for Fidelity's ETF).

- Place a buy order, just as you would for any other stock.

Frequently Asked Questions (FAQ)

Q1: If I buy a Bitcoin ETF, do I own Bitcoin? No. You own a share in a fund that owns Bitcoin. You do not have direct control over the underlying BTC and cannot, for example, send it to a self-custody wallet. This is the primary trade-off for the convenience and simplicity of the ETF.

Q2: Is a Bitcoin ETF the same as buying Bitcoin on an exchange like OKX? No. Buying on an exchange like OKX means you are buying the actual underlying cryptocurrency, which you can then withdraw and hold yourself. The ETF is a security that tracks the price.

Q3: What are the fees for a crypto ETF? ETFs charge an "expense ratio," which is a small annual fee expressed as a percentage of your investment. The competition in the Bitcoin ETF space is fierce, and many issuers are offering very low expense ratios.

Q4: Can I hold a crypto ETF in my retirement account (like a 401k or IRA)? Yes. This is one of the most significant advantages of the ETF structure. You can hold a spot Bitcoin ETF in a tax-advantaged retirement account, which is not easily done with actual cryptocurrency.

Q5: Is a crypto ETF a safe investment? The ETF itself is a regulated and secure product. However, it is still subject to the high price volatility of the underlying cryptocurrency. An investment in a Bitcoin ETF is still an investment in Bitcoin and carries the same market risk.

Conclusion

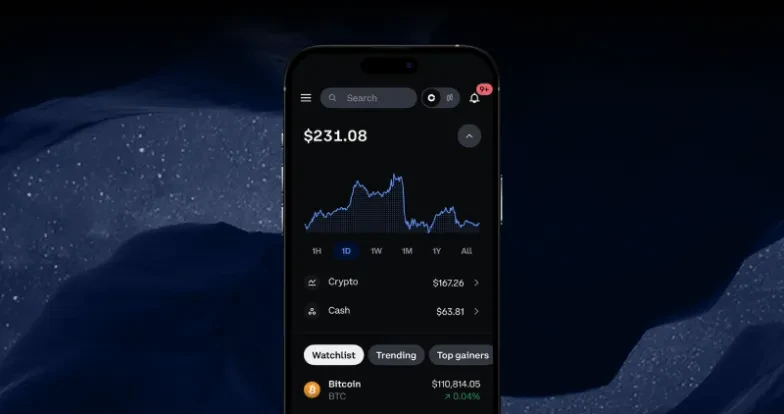

The crypto ETF is a revolutionary product that has built a secure and regulated bridge between the worlds of traditional finance and digital assets. By making it easy for anyone to invest in assets like Bitcoin through a standard brokerage account, ETFs are set to accelerate the mainstream adoption of cryptocurrency and usher in a new era of institutional investment. While direct ownership on an exchange like OKX offers the full sovereignty of crypto, the ETF provides a simple and powerful alternative for a new class of investors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The value of crypto ETFs can be highly volatile, and you should consult with a qualified financial advisor to determine if this type of investment is right for your portfolio.

© 2025 OKX. Se permite la reproducción o distribución de este artículo completo, o pueden usarse extractos de 100 palabras o menos, siempre y cuando no sea para uso comercial. La reproducción o distribución del artículo en su totalidad también debe indicar claramente lo siguiente: "Este artículo es © 2025 OKX y se usa con autorización". Los fragmentos autorizados deben hacer referencia al nombre del artículo e incluir la atribución, por ejemplo, "Nombre del artículo, [nombre del autor, si corresponde], © 2025 OKX". Algunos contenidos pueden ser generados o ayudados por herramientas de inteligencia artificial (IA). No se permiten obras derivadas ni otros usos de este artículo.